Artesia

Debt

Capital

Markets

Artesia

Debt

Capital

Markets

ADCM offers bespoke transaction and consultancy support to carefully selected players in the alternative debt and FinTech scene.

Building upon our extensive network, ability to innovate, industry expertise and track record we relentlessly dedicate ourselves to the growth potential of our clients and partners✦

ADCM offers bespoke transaction and consultancy support to carefully selected players in the alternative debt and FinTech scene.

Building upon our extensive network, ability to innovate, industry expertise and track record we relentlessly dedicate ourselves to the growth potential of our clients and partners✦

We provide capital, advisory services and consulting to innovators in the financial services industry✦

At ADCM we provide capital, advisory services and consulting to innovators in the financial services industry✦

Core team

Philip

Niemeyer

Philip is responsible for commercial matters, ie. business development, sales, fundraising and building partnerships and co-operations in the FinTech and alternative finance space across Europe. His expertise includes investor relations and regulatory matters. He has experience in sourcing fixed income mandates jointly developed with many types of (online) lenders. He has successfully acquired institutional investment mandates and built innovative strategic partnerships with small and large financial institutions. Philip is also very well connected with the European FinTech ecosystem. Philip completed Masters in Law and in Finance at the University of Groningen and Duisenberg School of Finance (University of Amsterdam), respectively. Philip is a frequent speaker at industry events in the lending and FinTech space.✦

Jetze

Sikkema

As Chief Financial Technology Officer, Jetze is responsible for all data and quantitative related matters, including financial modelling. His key expertise is predictive modelling and machine learning. Jetze holds a degree on in Mathematical Physics from the University of Groningen and has worked in various roles necessary for a data scientist: from software engineer, creating among others, algorithmic trading software to developing machine learning algorithms. Furthermore Jetze consults for the hedge fund industry and manages @ukfactcheckpolitics, one of the largest fact checkers in the UK ✦

Povilas Mockus

Povilas is responsible of deal flow and keeping track of the due-diligence processes. His key expertise is in Corporate Finance. Povilas previously held internships in the Baltic Private Equity and Dept Capital Markets sectors. Next to working at A-DCM, Povilas currently studies for his MSc in Corporate Finance at the University of Amsterdam and holds a degree in Economics from Tilburg University (We hope to welcome back Povilas on a short term basis). ✦

Board of Advisors

Jan

Poot jr.

Jan has 40+ years of experience in the institution nal sector working for ABN AMRO Bank, Swiss Banking Corp., Columbia Threadneedle, AEGON Asset Management and Vontobel Asset Management. AT Aegon, Jan was responsible for European Institutional Sales. As owner of Porterville he currently offers distribution and advisory services to a limited amount of successful private equity, real estate- and investment management companies. He also acts as an advisor- and investor to Chipshol Family Office. Jan holds a Masters Degree in Macro Economics at the University of Saint Gall, Switzerland.✦

Pedro Pinto

Coelho

Innovative, agile and multi-award winning banking leader with over 25 years’ international financial services experience with leading blue-chip institutions across three continents in progressive leadership roles, both executive and NED, in Digital Banking/Fintech, Investment Banking, Wealth Management, general management, business development and strategy. Industry recognised as a pioneer enabling challenger banks to establish strategic partnerships with FinTechs to create profitable financial products using an ‘open architecture model.✦

George

Patellis

George has significant international IB and credit experience. He has been in charge of the establishment of several leading lenders, from start-up to fully functional lenders, spanning North America and Europe having held an array of international executive positions including Operations Director and MD for Preferred Mortgages (Barclays MBO). George has also held executive level positions at Lehman Brothers, IMC Mortgage Company and Washington Mutual. Through his experience and an extensive network of contacts in the broker and banking community, George offers up-to-the-minute knowledge of lending sector. ✦

Core team

Philip

Niemeyer

Philip is responsible for commercial matters, ie. business development, sales, fundraising and building partnerships and co-operations in the FinTech and alternative finance space across Europe. His expertise includes investor relations and regulatory matters. He has experience in sourcing fixed income mandates jointly developed with many types of (online) lenders. He has successfully acquired institutional investment mandates and built innovative strategic partnerships with small and large financial institutions. Philip is also very well connected with the European FinTech ecosystem. Philip completed Masters in Law and in Finance at the University of Groningen and Duisenberg School of Finance (University of Amsterdam), respectively. Philip is a frequent speaker at industry events in the lending and FinTech space.✦

Jetze

Sikkema

As Chief Financial Technology Officer, Jetze is responsible for all data and quantitative related matters, including financial modelling. His key expertise is predictive modelling and machine learning. Jetze holds a degree on in Mathematical Physics from the University of Groningen and has worked in various roles necessary for a data scientist: from software engineer, creating among others, algorithmic trading software to developing machine learning algorithms. Furthermore Jetze consults for the hedge fund industry and manages @ukfactcheckpolitics, one of the largest fact checkers in the UK.✦

Povilas Mockus

Povilas is responsible of deal flow and keeping track of the due-diligence processes. His key expertise is in Corporate Finance. Povilas previously held internships in the Baltic Private Equity and Dept Capital Markets sectors. Next to working at A-DCM, Povilas currently studies for his MSc in Corporate Finance at the University of Amsterdam and holds a degree in Economics from Tilburg University (We hope to welcome back Povilas on a short term basis). ✦

Board of Advisors

Jan

Poot jr.

Jan has 40+ years of experience in the institution nal sector working for ABN AMRO Bank, Swiss Banking Corp., Columbia Threadneedle, AEGON Asset Management and Vontobel Asset Management. AT Aegon, Jan was responsible for European Institutional Sales. As owner of Porterville he currently offers distribution and advisory services to a limited amount of successful private equity, real estate- and investment management companies. He also acts as an advisor- and investor to Chipshol Family Office. Jan holds a Masters Degree in Macro Economics at the University of Saint Gall, Switzerland.✦

Pedro Pinto

Coehlo

Innovative, agile and multi-award winning banking leader with over 25 years’ international financial services experience with leading blue-chip institutions across three continents in progressive leadership roles, both executive and NED, in Digital Banking/Fintech, Investment Banking, Wealth Management, general management, business development and strategy. Industry recognised as a pioneer enabling challenger banks to establish strategic partnerships with FinTechs to create profitable financial products using an ‘open architecture model.✦

George

Patellis

George has significant international IB and credit experience. He has been in charge of the establishment of several leading lenders, from start-up to fully functional lenders, spanning North America and Europe having held an array of international executive positions including Operations Director and MD for Preferred Mortgages (Barclays MBO). George has also held executive level positions at Lehman Brothers, IMC Mortgage Company and Washington Mutual. Through his experience and an extensive network of contacts in the broker and banking community, George offers up-to-the-minute knowledge of lending sector.✦

Private debt opportunities in the form of a conventional securities and supported by the latest technology can offer institutional investors the distinct benefits of public securities that are currently not available to the majority of investors.✦

Access to cross-border private debt opportunities

Better economics due to innovative structure, technology and proprietary distribution

Regulatory capital efficiencies due to increased transparency & look-trough, rating, credit and insurance enhancement

Via listing and daily pricing institutions may improve access to secondary liquidity

Real-economy borrowers get access to better funding alternatives while providing institutions with unique risk/return

Private debt opportunities in the form of a conventional securities and supported by the latest technology can offer institutional investors the distinct benefits of public securities that are currently not available to the majority of investors.✦

Access to cross-border private debt opportunities

Better economics due to innovative structure, technology and proprietary distribution

Regulatory capital efficiencies due to increased transparency & look-trough, rating, credit and insurance enhancement

Via listing and daily pricing institutions may improve access to secondary liquidity

Real-economy borrowers get access to better funding alternatives while providing institutions with unique risk/return

Next steps

Next steps

Dutch FinTech SME Platform:

Advised on the establishment of a private securitisation program, refinancing a major UK investment bank securing over €60 million of capital.

Challenger Bank:

Provided strategic advice on the restructuring and sale of a ~€250 million consumer credit portfolio.

UK Bridge Lender:

Arranging and advising a €250 million ABS issuance program to finance UK short term real estate lending.

Corporate Lender:

Structured a €500 million warehouse facility to be used to support future loan origination and funding needs by European mid market corporates.

Pension Fund & Private Equity Fund:

Advised on the formation of a green lending joint venture, including strategic business case development.

Swissfund, October 2024:

ADCM advised Swishfund and Roodhals Capital on the establishment of a private securitisation structure, acting as bookrunner, arranger and structuring agent. The transaction refinanced an existing UK bank and attracted additional capital to support the continued growth of Swishfund’s loan book.

Billink, June 2025:

ADCM advised Billink on strengthening its capital markets profile and expanding its financing capacity for receivables in support of its growth in the Dutch market. ADCM acted as sole arranger, structurer, and bookrunner for a privately placed securitisation.

Pearl Capital, November 2025:

ADCM facilitated raising an initial tranche of €160 million as part of a €350 million institutional credit facility for Pearl Capital. Pearl capital operates in the Dutch short term bridge lending space, allowing it to realize it’s ambition to grow into the market leader.

Dutch FinTech SME Platform:

Advised on the establishment of a private securitisation program, refinancing a major UK investment bank securing over €60 million of capital.

Challenger Bank:

Provided strategic advice on the restructuring and sale of a ~€250 million consumer credit portfolio.

UK Bridge Lender:

Arranging and advising a €250 million ABS issuance program to finance UK short term real estate lending.

Corporate Lender:

Structured a €500 million warehouse facility to be used to support future loan origination and funding needs by European mid market corporates.

Pension Fund & Private Equity Fund:

Advised on the formation of a green lending joint venture, including strategic business case development.

Swissfund, October 2024:

ADCM advised Swishfund and Roodhals Capital on the establishment of a private securitisation structure, acting as bookrunner, arranger and structuring agent. The transaction refinanced an existing UK bank and attracted additional capital to support the continued growth of Swishfund’s loan book.

Billink, June 2025:

ADCM advised Billink on strengthening its capital markets profile and expanding its financing capacity for receivables in support of its growth in the Dutch market. ADCM acted as sole arranger, structurer, and bookrunner for a privately placed securitisation.

Pearl Capital, November 2025:

ADCM facilitated raising an initial tranche of €160 million as part of a €350 million institutional credit facility for Pearl Capital. Pearl capital operates in the Dutch short term bridge lending space, allowing it to realize it’s ambition to grow into the market leader.

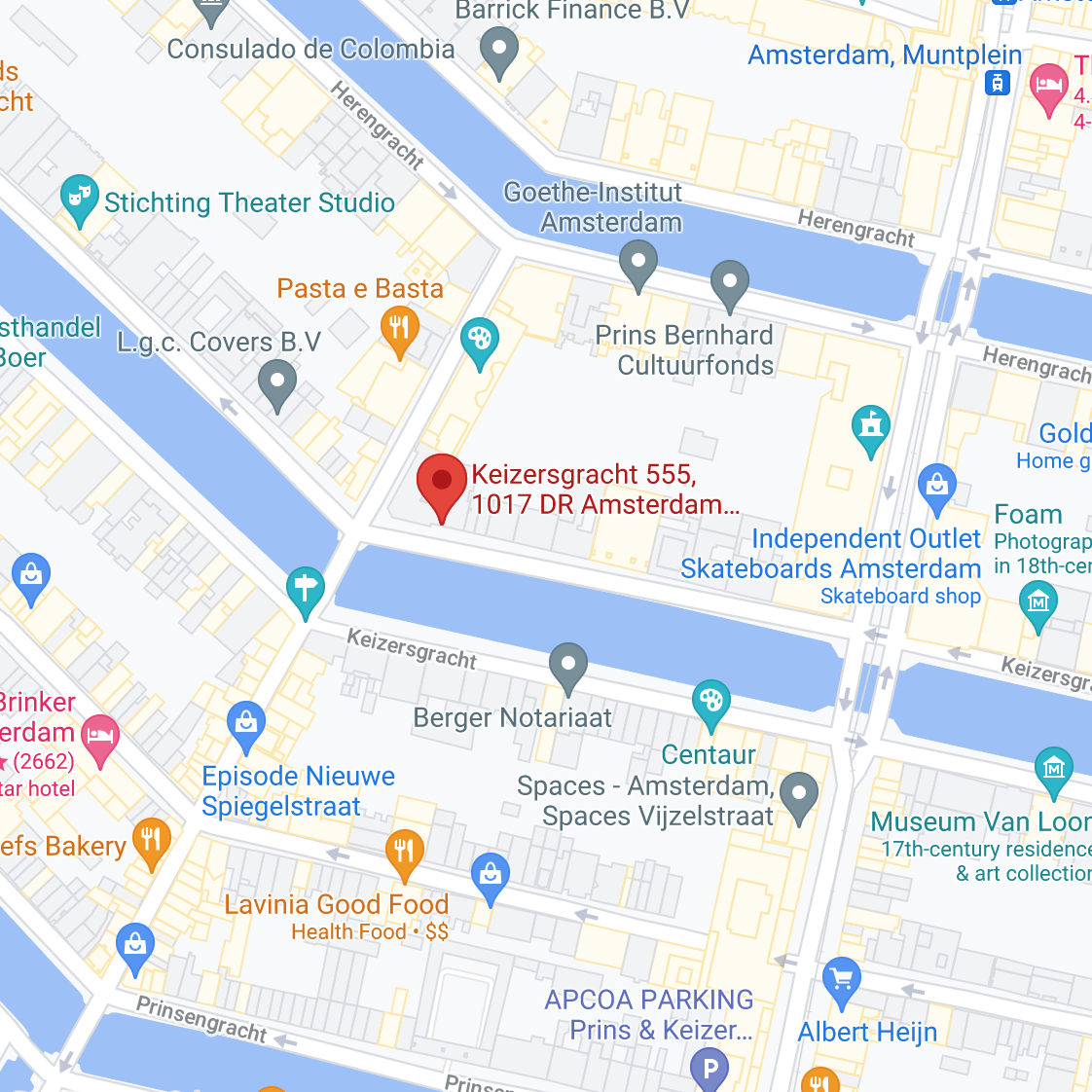

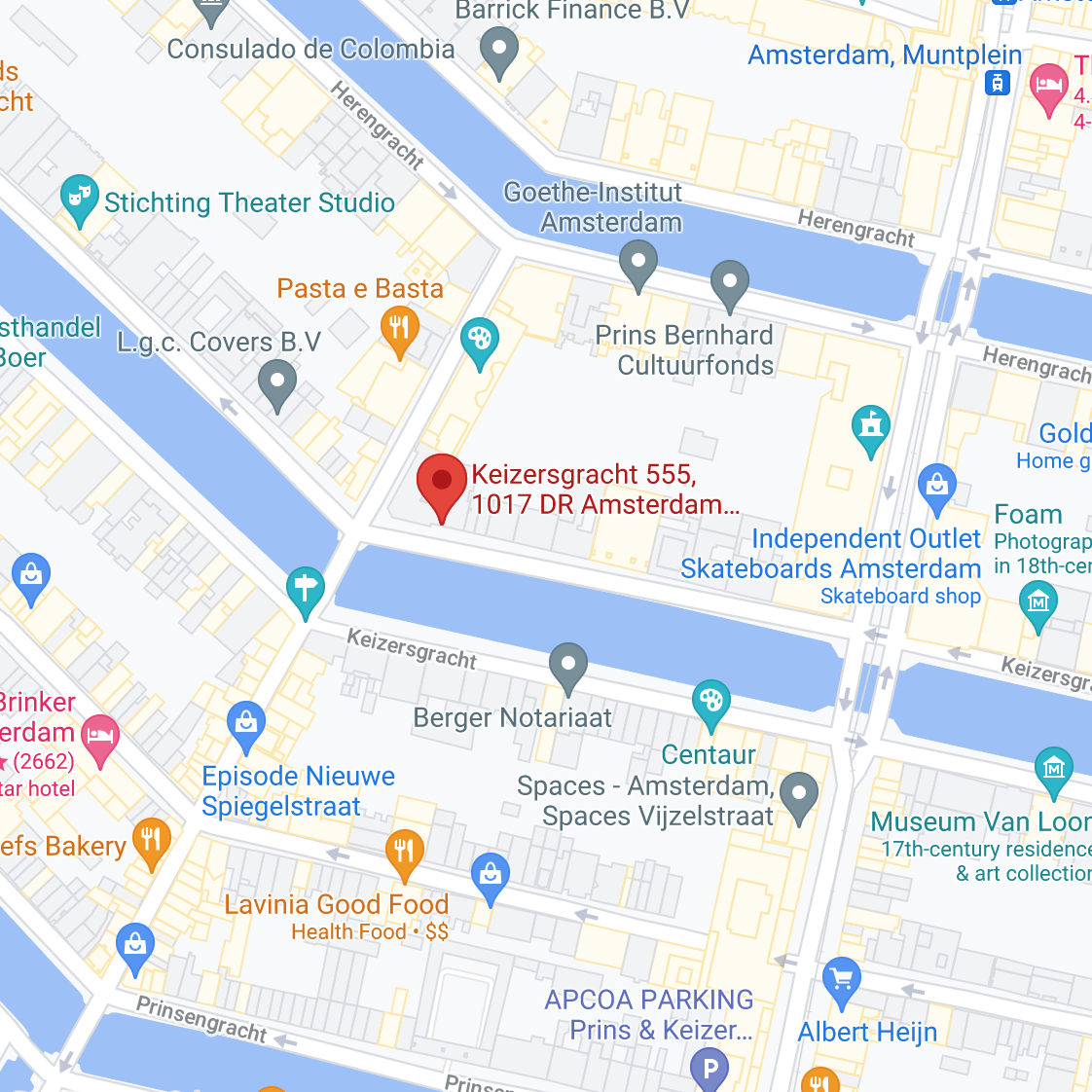

ADCM✦

is based

in Amsterdam

ADCM✦

is based in Amsterdam